First, set realistic goals: Set realistic financial goals for yourself and your family, and break them down into smaller, achievable steps. Celebrate your successes along the way to help stay motivated.

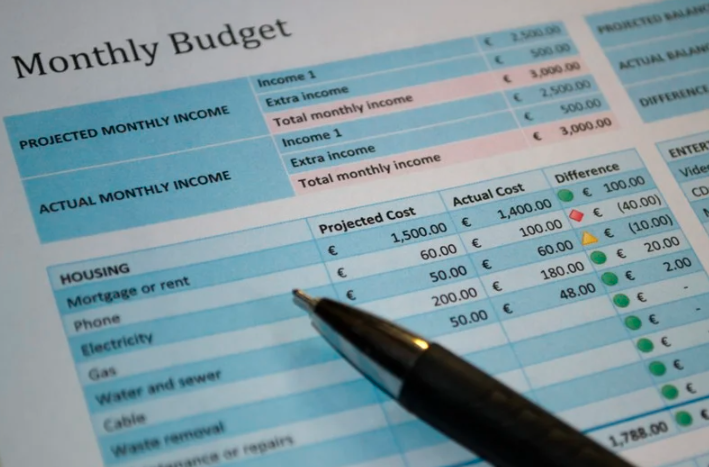

Create a budget: Start by creating a budget that outlines all of your monthly expenses and income. This will help you keep track of where your money is going and where you can make cuts.

Prioritize bills: Make sure to prioritize bills that are essential, such as rent, utilities, and food. Pay these bills first before spending money on non-essential items.

Cut unnecessary expenses: Take a look at your budget and see where you can cut expenses. This might mean canceling subscriptions, eating out less, or finding ways to save on utility bills.

Look for ways to earn extra income: Consider taking on a part-time job or finding ways to make extra money on the side, such as freelancing or selling items you no longer need.

Plan meals: Plan meals ahead of time to save money on groceries and avoid eating out. Look for sales and buy in bulk when possible. Once a month shopping can show you where you need to cut out certain items and can buy more of other items. Frozen and canned foods can be substituted for some fresh produce such as: beans, green beans, corn, carrots, cauliflower, broccoli, and certain fruit.

Use public transportation or car pool: Consider using public transportation instead of owning a car. This can save you a lot of money on gas, maintenance, and insurance.

Connect with your community: Seek out community resources and support systems that can help you achieve your goals. Look for community resources that can help you save money, such as food banks, thrift stores, and free events. This might include community organizations, job training programs, or financial coaching services. One organization we suggest looking into is your local Buy Nothing Project: a gifting economy where people give from their excess, their generosity, and their hearts.

Learn to repair items: Instead of buying new items, learn to repair items yourself. This can save you money in the long run and help you develop valuable skills. Sewing minor rips, missing buttons, and re-hemming pants is only one start to learning these skills. Replacing light bulbs, tightening screws, super-gluing a broken piece of something, or even learning to solder can save a few dollars here and there. Give away or toss severely broken or irreparable items.

Build an emergency fund: Start building an emergency fund to help you cover unexpected expenses, such as car repairs or medical bills. Start with a small amount, such as a penny here, ten cents there, a dollar or two. You need at least $500 to cover minor car repairs, and even with Medicaid, medical expenses such as over-the-counter medications can add up.

Stay positive: It can be challenging to live on a low income, but staying positive and focused on your goals can help you get through tough times. Remember that every little bit helps, and with perseverance, you can improve your financial situation over time.