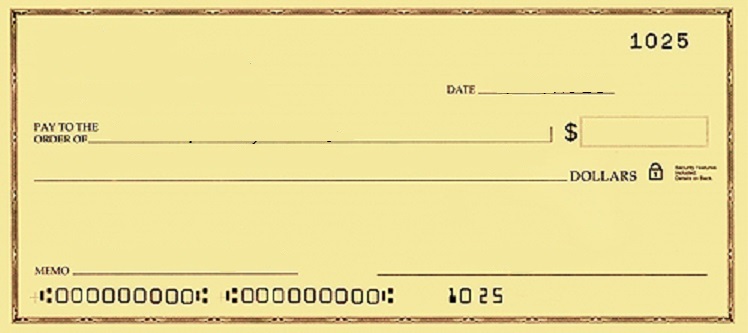

In the budgeting/money management category, we’re going to talk about writing a check. A basic check looks like this:

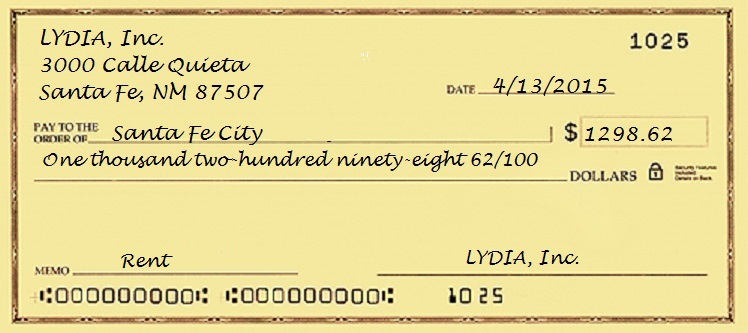

The check writer’s name goes in the top left corner and the check number is in the top right. The date goes below the check number. On the “Pay to the Order Of” line, that’s where the writer puts the recipient’s name, such as Suzie Homemaker or Santa Fe City Works. The $ is where the amount of the check (how much money) should be written, i.e. $1,298.62. The line underneath the Pay to the Order of line, beside the word “Dollars”, is where the full amount is written out, such as Twelve hundred ninety-eight and sixty-two or one thousand two hundred ninety-eight and sixty-two. The memo line tells the recipient, the writer and the banks what the check does or who it is for – such as “Rent”. The line on the other side of the memo line is where the writer signs his/her name, such as Suzy Homemaker.

Under the memo line is a group of numbers. The first string is the routing number – this tells the recipient’s bank which bank the writer uses (which bank the check is drawn on). The second string is the account number – it tells the recipient’s bank whose checking account to use. The third string is the check number (it should match the number on the top right of the check).

The completed check should be filled out similarly:

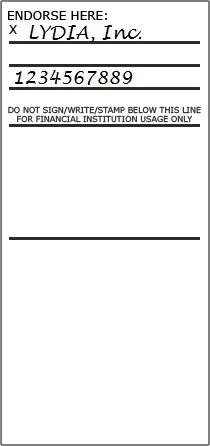

When one receives a check, in order to cash or deposit it, one must flip the check over and sign his/her name. Including the recipient’s account or access number on the back helps the bank more accurately deposit the funds into the correct account.