When you look at your checkbook – remember we discussed writing checks? Well, this time, we’re talking about keeping up with the amount of your check. So we’re going to look at the back of the checkbook and you’ll find an area called the checkbook register. This is where you write date, recipient/reason for the check, the amount, and finally, if it cleared/or was paid out – and if it equals your bank statement.

The checkbook register looks like this:

Notice it says “Number/Code”, “Date”, “Transaction” “Amount” a little checkmark to note it’s gone through,“Fees”, “Deposits”, and Balance – well, my copy didn’t quite turn out right, but that last column is for the balance.

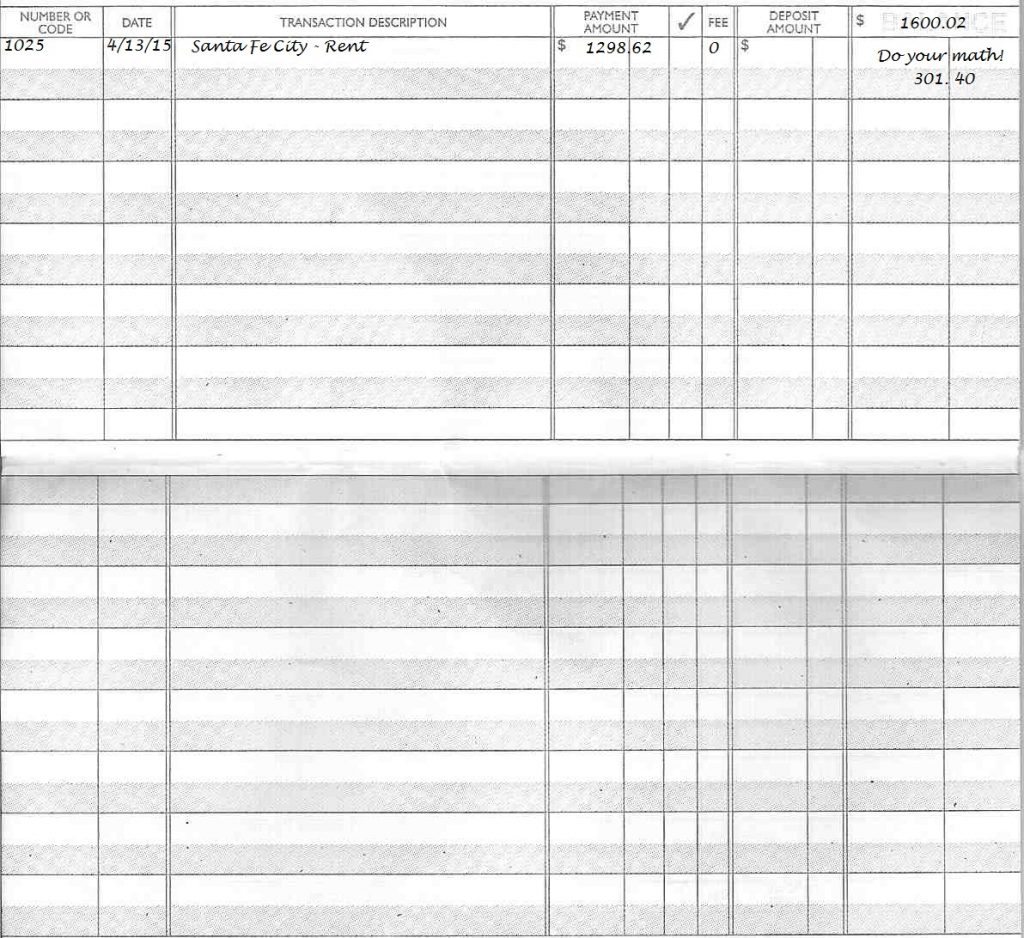

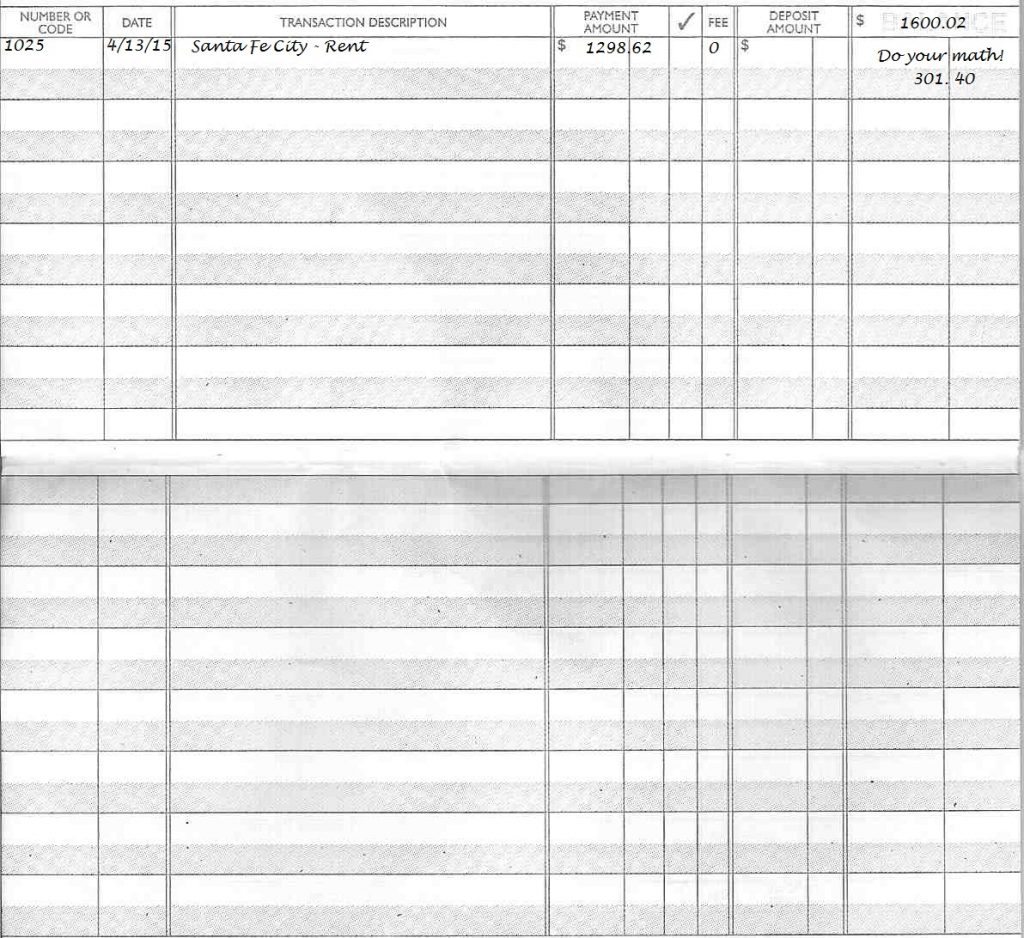

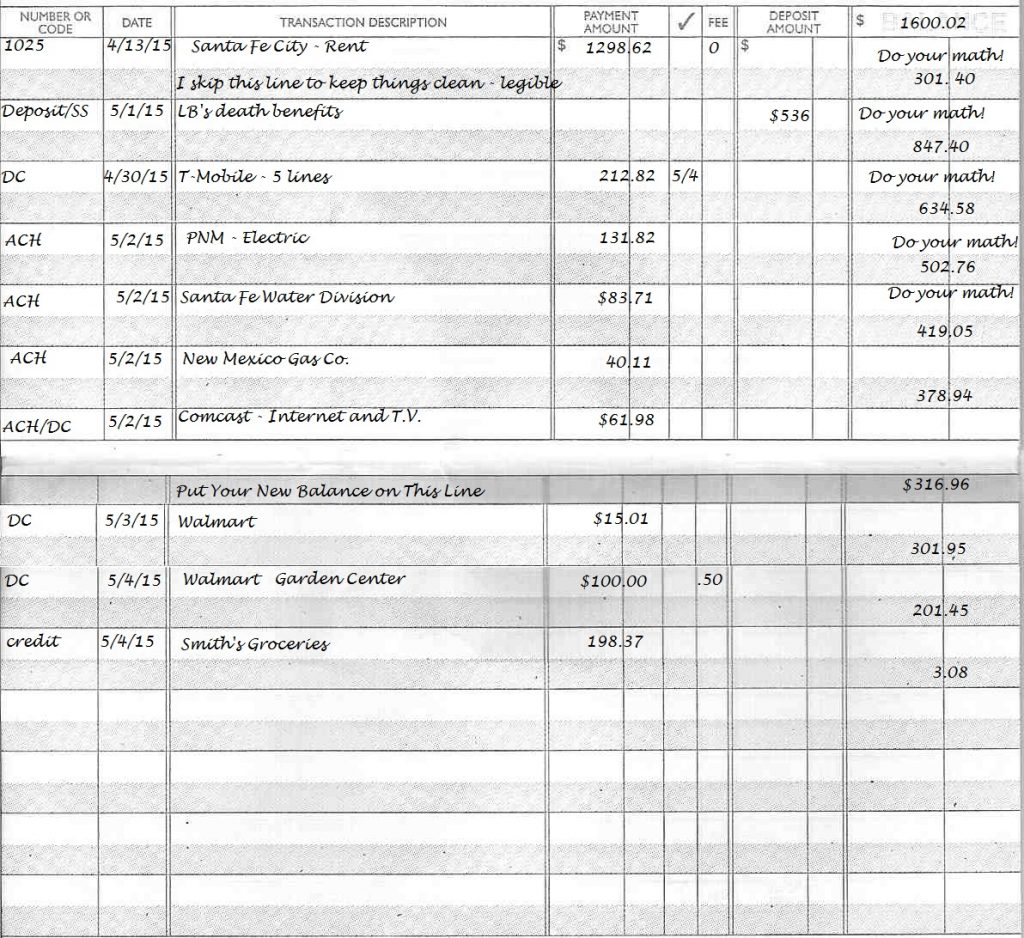

It says Number/Code to record your check number – we used number 1025 last time, so we’ll keep it simple and use that check again. Then I write the date for the check, 4/13/2015. My transaction was Santa Fe City – “Rent”. My amount was $1298.62. It cleared – I like to record the date it cleared instead of just marking it – and I’ll mark it on both my bank statement and in my register. If I started with a $1600.02 balance, then I write that across the top for “Balance” – my personal choice/preference. From there, I subtract the amount of the check (I prefer to use a calculator to get accurate results). $1600.02 – $1298.62 = $301.40. This is my new balance: $301.40 and I record that in the balance column.

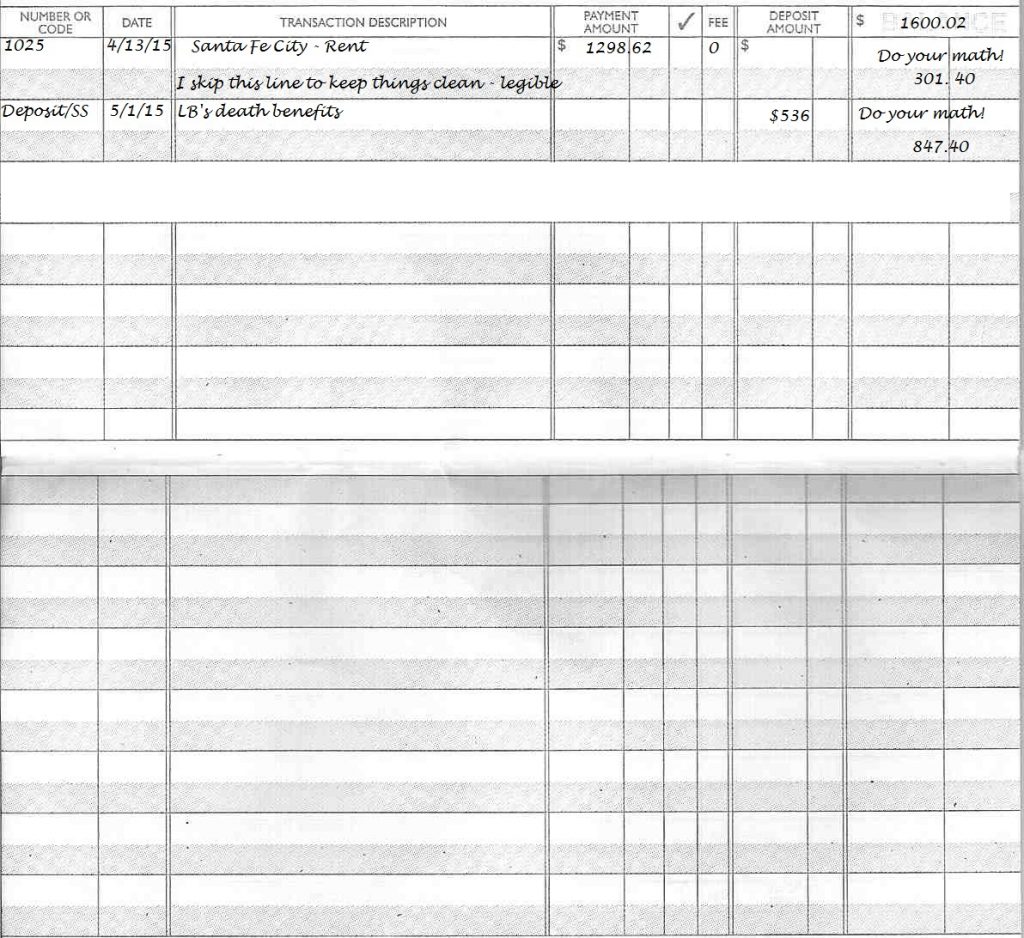

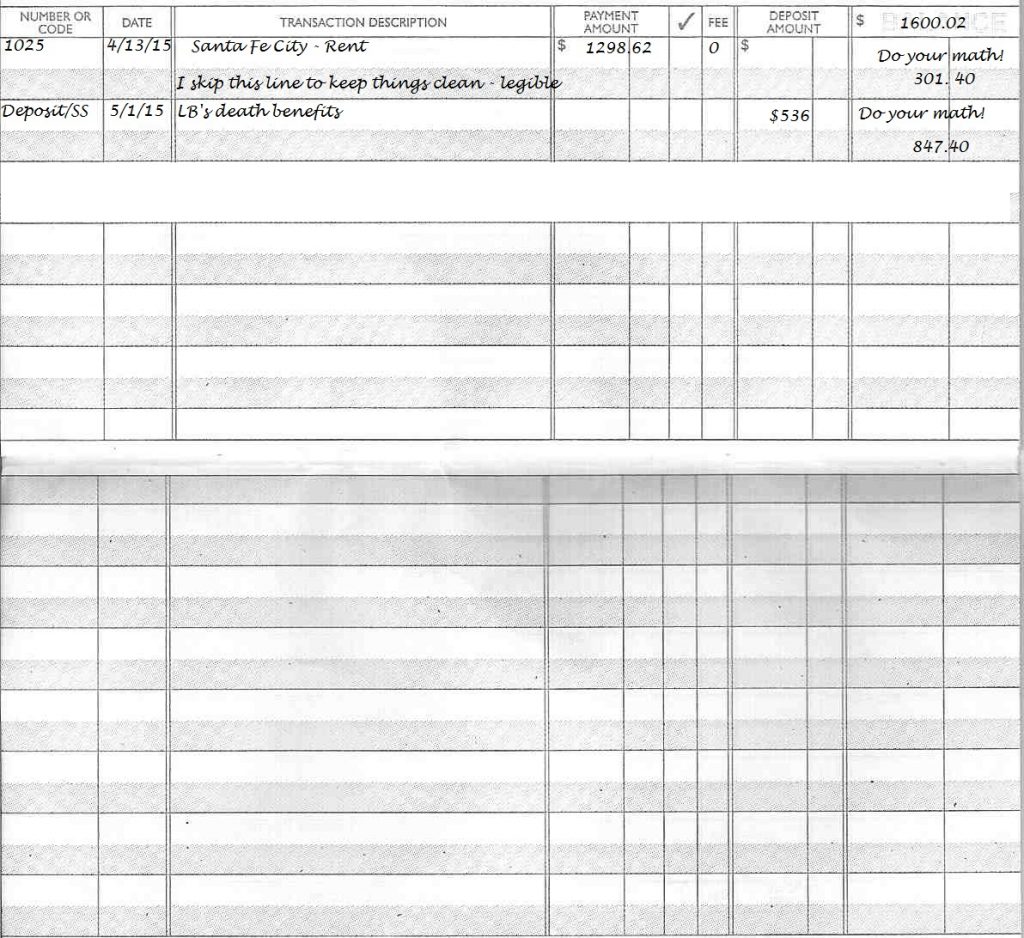

I receive money for my daughter’s care from her dad’s death benefits, God rest his soul. That goes in the register too. Number/Code: D (for deposit). Date: 5/1/2015. Transaction: death benefits. Amount stays empty – this is a deposit. Deposits: $536. I add the deposit – money coming in – to my new balance of $301.40. $301.40 + $536 = $837.40.

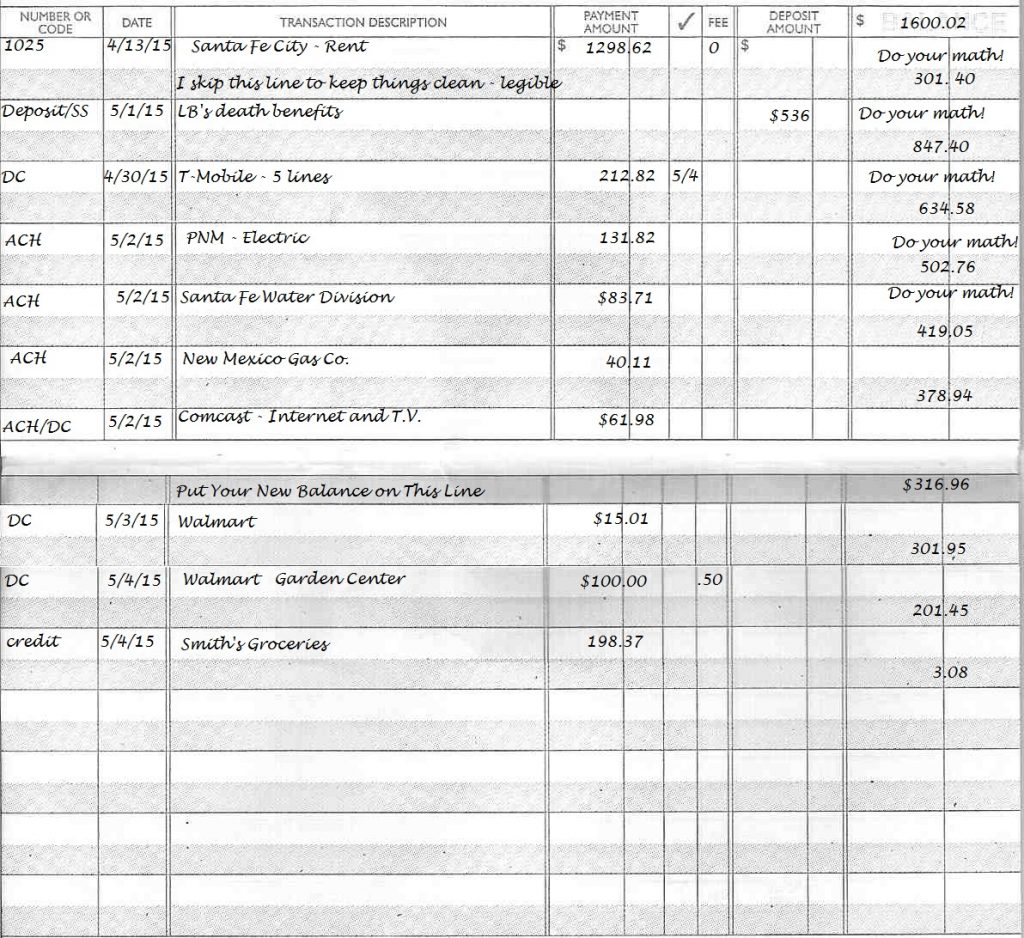

We’ll readdress at a later date, but I know I have to pay my phone, my electric, trash/sewer/water, gas, television/internet, and still buy groceries. I pay my bills online, so I will either use “I” for Internet in my number/code, or “ACH” for Automated Clearing House (an electronic check, basically), or even “DC” for Debit Card and “C” for Credit.

Whoops! I forgot to account for gas in my car. Looks like I’ll be walking until the next payday! (Thankfully my rent isn’t really $1298.62 – it’s much more affordable than that.) I used real and estimated amounts for my bills. I like to skip lines and keep a clean register, helps me read it. When I sit down with my bank statement, I’ll note if and when it cleared. This helps me keep a more accurate running tally of the money in my bank account.

I, personally, don’t use my check register. I probably should! My bank takes automatic payments out and shows me the pending amount. But I’ve gotten into trouble a couples times where I thought I had $100 in the bank, paid $30 in gas, and then it held only $1 out and messed up my account balance in that I had to remember to account for the $30 less. When you desperately need that gallon of milk and loaf of bread, not knowing the exact amount in your account can get stressful.